You may have heard about stocks before. But regardless of whether you know what they are or not, stocks have been a trending topic for years.

You may have heard about stocks before. But regardless of whether you know what they are or not, stocks have been a trending topic for years.

So… what are stocks and how do they work?

In simple words, stocks are shares of a company put out for sale. When sold, the buyer invests into the company, and expects a larger monetary return for their investment. There are generally two types of stocks, private and public. Public stocks are open to the general public, while private ones are closed off for wealthy investors.

Stocks are an extremely important concept today, with young people interested in the subject as well, maybe even investing themselves.

Many children from the upper to upper-middle classes have extensive knowledge on stocks, many of them learning through their parents.

It’s truly amazing that so many young people know about stocks. This financial intelligence has set them up for the rest of their life.

But we can’t ignore the fact that not everyone has this knowledge.

Unlike financially literate teenagers who come from an upper to upper-middle class background, not everyone’s parents have the money to invest in stocks, thus not having the knowledge to do so either. The children of these parents won’t have the same advantage as the upper-class children, so they most likely won’t be able to invest in stocks like their parents. This leads to a vicious cycle based off of generational wealth.

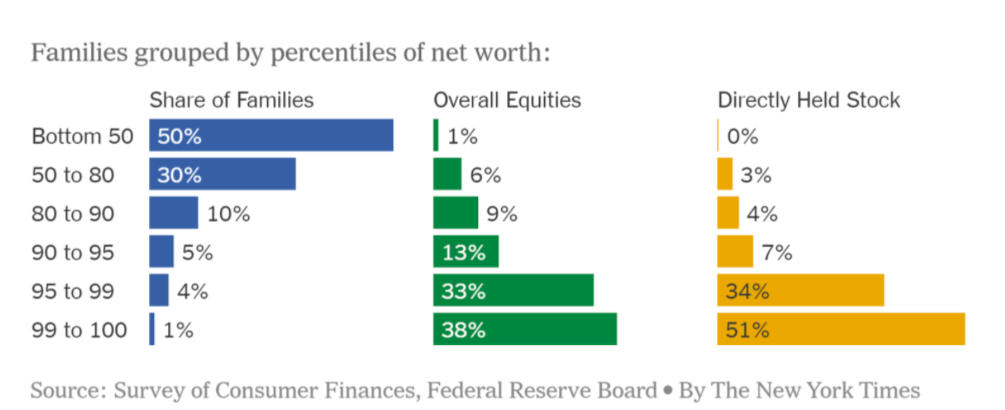

The Survey of Consumer Finances is a survey conducted once every three years which gathers financial information from individual families. This financial information ranges from the income of the families, to the assets they own. This includes stocks.

This chart shows the directly held stock held by each group of families based on net worth.

Directly held stock is when you directly purchase the stocks without attachment to another entity bringing the stocks to you, while Indirectly held stock is when you invest in the stock market through mutual funds or exchange traded funds. Mutual funds are investments in which you “pool” money with other investors. You and this group of investors will basically invest together.

Indirectly held stock is less risky to own than directly held stock, but directly held stock is more profitable.

Focusing on the stock section of the graph, we see that families in the bottom 50% own *approximately* none of the directly held stock. In stark contrast, we see the top 5% own 85% of all Directly Held stock.

Because indirectly held stock is much safer for middle and lower class people to own, they most likely won’t invest in directly held stock. This is why we see this stark contrast with the top 10% of families owning the majority of directly held stocks.

Seeing these differences already highlights the large gap between the rich and the poor in America. While the rich can make these huge, risky investments, the poor can barely afford to make one at all, and we will see more of that in the next graph.

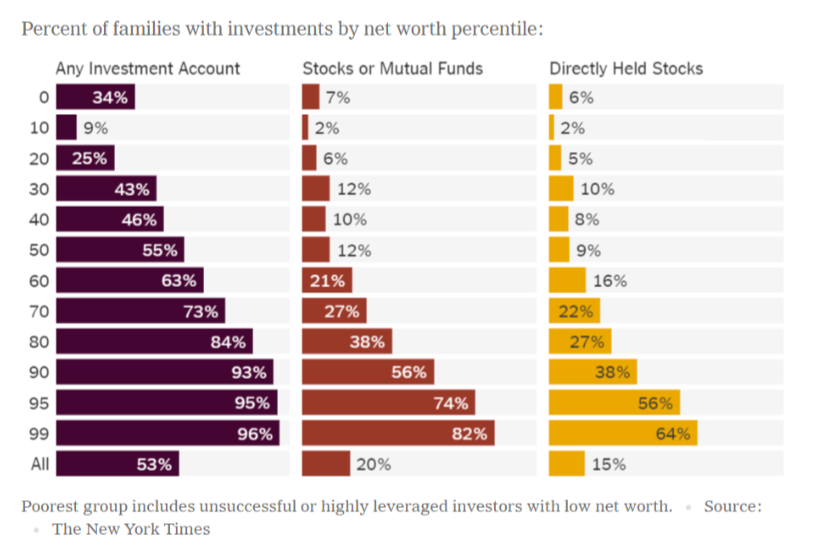

Note: Keep in mind that this graph shows the percentage from each group which owns these investments, while in the previous graph we were looking at which groups own, percentage wise, more of the type of investment which is mentioned.

From this graph, we do see that Stocks or Mutual Funds are more inclusive than Directly Held stocks considering the security that comes from this type of investment. But, mutual funds are still not as beneficial as Directly Held Stocks, which still leaves the lower classes behind and contributes to the growing inequality between the upper class.

We also see that the percentage of mutual fund holdings compared to directly held stocks aren’t very different for families whose net worth is in the lower 50th percentile, leaving the poorest families right where they are while the rich are stepping forward everyday. Again, contributing to the increasing inequality gap.

Now if you don’t believe me, there is mathematical evidence that proves that the stock market is contributing to the wealth gap.

The “Gini Coefficient” is a measure of the wealth gap between a particular social group or country.

In 1980, there was an increase in the value of the Stock market. Following this, the Gini Coefficient had a 2% increase. Overtime with the stock market value increasing, there was an overall 3% increase in the Gini Coefficient.

That was back in the 1980’s and early 2000’s, nowadays, the stock market value is much larger, and the Gini Coefficient is as well. In June of 2022, it was reported that the Gini Coefficient is .485, the highest it has been in over 50 years.

So, the stock market technically doesn’t affect lower class people in any way; meaning that it doesn’t help them nor hurt them, but it does leave them in the dirt.

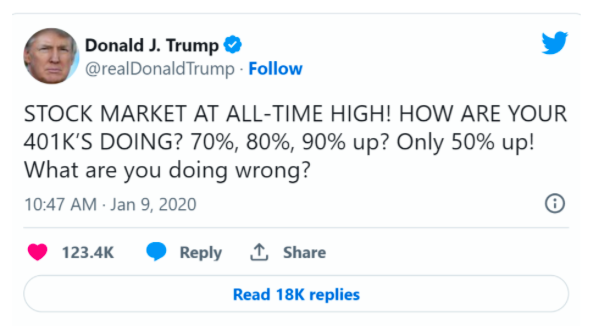

Former U.S. presidents like Donald Trump have publicly supported the growth of the stock market (which only majorly benefits the incredibly rich). If we think about it, the stock market really doesn’t help anyone or make our country a better place.

The rich don’t need more money, but the poor do.

Tweets like this are almost a mockery to lower class people. Donald Trump very openly liked to brag about how the stock market boomed during his presidency, but he rarely talked about which group the stock market boom benefited.

He didn’t ever mention that the 600,000 homeless people who don’t have enough money to even afford shelter wouldn’t benefit from the stock market boom.

So in short, yes, the stock market does make the rich richer and the poor “poorer”. Although the poor aren’t directly affected by stocks, meaning that they don’t get money taken away from them, they still are negatively impacted by the inequality. While the rich hoard up all the wealth AND take stocks to their advantage, the poor are left to struggle without opportunity to grow their assets.

The system is unfair, and unless stocks become somehow more inclusive, this wealth gap will continue growing in the coming years.

Sehar Sarang is a writer, founder, and activist. Her blog, Open Your Ears, focuses on bringing awareness and justice to solved and unsolved crime cases. She is also the Assistant Editor in Chief of SeaGlass Literary, a youth literature magazine focused on amplifying the voices of younger people. As a freelancer, Sehar specializes in writing about social issues related to women, people of color, and other marginalized communities. Outside of writing, she is the founder of two non-profit organizations, and is currently running a campaign to increase COVID-19 vaccinations in India’s impoverished communities.

Sehar Sarang is a writer, founder, and activist. Her blog, Open Your Ears, focuses on bringing awareness and justice to solved and unsolved crime cases. She is also the Assistant Editor in Chief of SeaGlass Literary, a youth literature magazine focused on amplifying the voices of younger people. As a freelancer, Sehar specializes in writing about social issues related to women, people of color, and other marginalized communities. Outside of writing, she is the founder of two non-profit organizations, and is currently running a campaign to increase COVID-19 vaccinations in India’s impoverished communities.

There are no comments

Add yours